Introduction

Financial stress is one of the almost universal challenges people face in the world today. With monthly bills, retirement planning, and wealth generation, one can quickly become overwhelmed by the pressure to reach financial independence. And this constant pressure does not affect your pocket, but in many cases, leaves scars on your mental well-being and physical health.

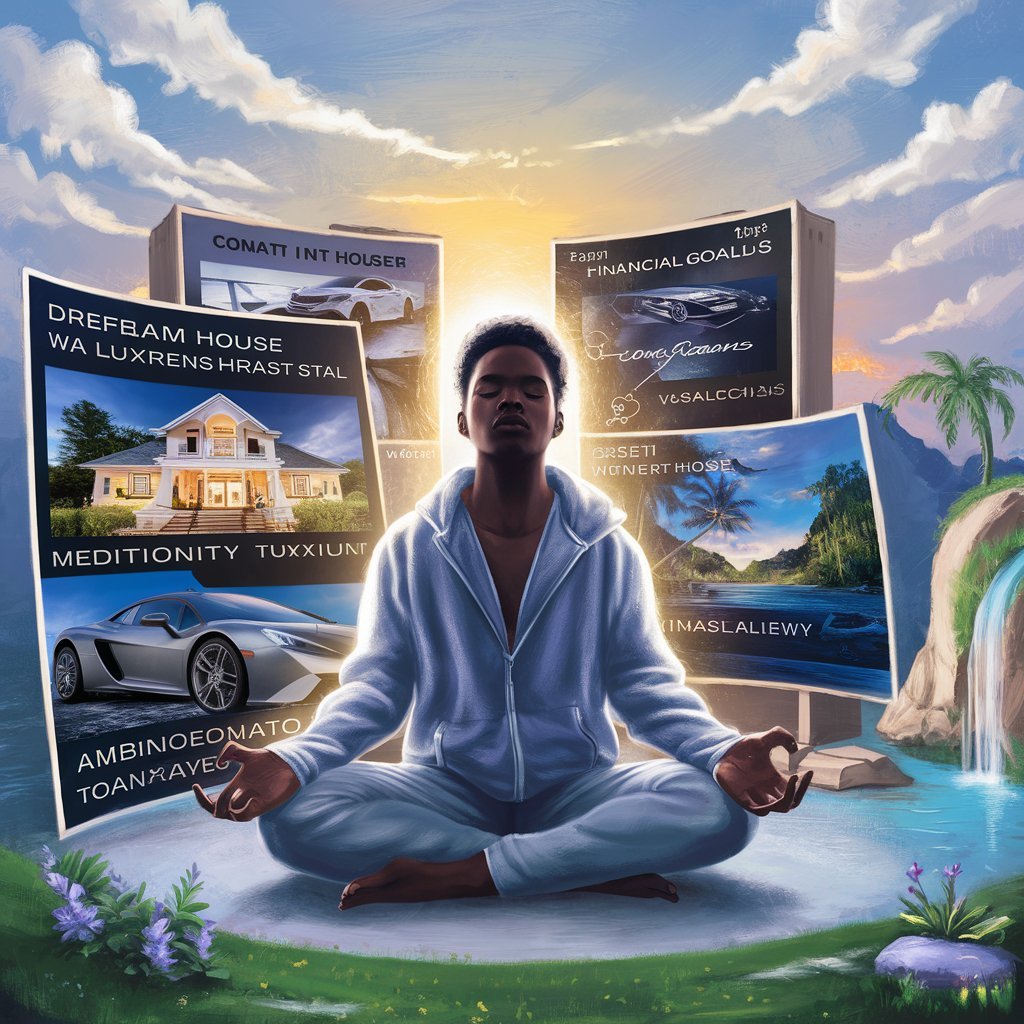

How would you like to glide through all that with clarity, focus, and peace of mind? Meditation is the answer. It has always been mainly related to mental well-being, but it is fast finding favor as one of the powerful means to attain one’s financial health. It is not merely an act of being silent; it directs one’s mind in the way it approaches money with mindfulness, positivity, and purpose.

This article has ten life-changing benefits for you to find in meditation as related to financial health and wealth creation. By the end of this article, you will grasp how meditation can shift your mindset about the state of your finances, lessen your financial stress, and help you reach your long-term wealth aspirations.

1. Reduces Financial Stress and Anxiety

Financial anxiety tends to lead into cycles of stress, preventing a person from thinking clearly or acting, whereas meditation has a calming effect on the nervous system. Cortisol, the stress hormone, is lowered, bringing you into a state of mental clarity. When you’re less anxious, you’ll be able to get back into the things that you have been putting off because of financial worries.

Practical Tip: Begin with an easy and quick guided meditation of five minutes” duration to help relieve financial anxiety-some deep breathing could help.

2. Improves Decision-Making

The most common reason for financial errors is fallen prey to emotional responses; be it panic selling investments or abusing credit to relieve stress. Meditation helps cultivate the opportunity to gain pause, reflection, and rational decision-making. By use, it bolsters the prefrontal cortex (which is in charge of logical thinking), and thus enables one to weigh risks and rewards in a better fashion.

Practical Tip: Use meditation to get in the zone before making big financial decisions: take a few moments to envision your financial goals and check whether this decision aligns with them.

3. Promotes a Positive Money Mindset

It is said that what you believe about money determines how you earn, save, and invest it. Negative mentalities like, “I’ll never have enough money” limit one’s potential. Hence, meditation can help reprogram those limiting beliefs and invoke an abundant mindset. Through affirmations and visualizations, meditation rewires your brain to focus on opportunities rather than obstacles.

Practical Tip: You can meditate on gratitude by concentrating on the financial blessings you already have-such as a stable job, roof over your head, or ability to pay your bills.

4. Enhances Focus on Long-Term Goals

Keen financial development sometimes needs patience and a focus on longer-term programs, such as saving for retirement or paying off debts. Reading meditation equips you with that added capacity to delay gratification, keeping you more concentrated on the future than on short-term temptations.

Practical Tip: Place your vision board beside you as you meditate, during which you visualize your financial goals. Example goals would be such as buying a new home, starting a new business, or planning for a debt-free life.

5. Reduces Impulsive Spending

Mindfulness meditation increases self-awareness, helping you recognize and control impulsive behavior. This is especially useful regarding ostensible offences when spending is concerned. It trains you to delay buying things. Meditating helps you prioritize needs over wants.

Practical Tip: Stop and take a few deep breaths before making any purchases. Ask yourself: Do I really need this? Will this support my financial goals?

6. Builds Emotional Resilience

Financial setbacks are bound to happen at various stages of one’s life, due to any unanticipated medical expense or even a market downturn. Meditation clearly teaches a person to be calm and resilient in times of adversity. Give yourself emotional stability to rise up again from financial difficulties in a rejuvenated and bright attitude.

7. Increases Creativity for Wealth Creation

It clears your mind from all thoughts, opening you up to new horizons, which encourages you to boost creativity. When it comes to generating business ideas, exploring investment opportunities, or constructing side hustles, one can use meditation to think out of the box.

Practical Tip: Take a few minutes out each day to meditate on the question, “What are new ways that I can increase my income?” Allow your mind to wander without judgment.

8. Fosters Gratitude and Financial Contentment

Gratitude is the pillar on which meditation stands. Meditation of gratitude enables one to take the focus away from lack towards nourishment. While this change of attitude seems too simple, it helps reduce scarcity mentality and build a healthy financial relationship.

Practical Tip:Always end with three financial blessings you express gratitude for during your meditation sessions.

9. Encourages Financial Harmony in Relationships

Money is one of the major reasons for conflicts in relationships. Meditation increases empathy, patience, and communication, which makes it easier to discuss financial matters with your partner or family. This unity, in turn, enhances cooperation in achieving common financial goals.

Practical Tip:Go for guided meditations together as a couple to align your financial goals with your relationship.

10. Aligns Your Financial Actions with Your Core Values

Meditation allows a connection with inner values whereby decisions regarding money can accord with what matters most to you. This may be giving, investing for experiences, or saving for a net worthy-end result; meditation brings clarity to your financial goal.

Practical Tip: Once in a while, check whether your spending and saving are consistent with your own values.

Conclusion

Many regard meditation as the surest way to achieve mental wellness; however, meditation has also been described as a transformative practice with the potential to ensure one’s financial well-being and wealth accumulation. Meditation empowers you to reduce stress, improve concentration, and engender a wealth-building mindset, all of which help you make better financial decisions and take advantage of new opportunities.

Take small steps. Even 5 to 10 minutes of being mindful every single day will change forever the way that you perceive your finances. Bear in mind that building wealth is as much an attitude as it is a number. With meditation, you are equipped with the skills needed for a calm, clear, and assured path toward financial independence.

Ready to take control of your financial future? Start your meditation journey today. Download a free guided meditation app or set aside just 5 minutes daily to practice mindfulness. Your wealth-building journey begins with a calm and focused mind. Take the first step toward financial freedom now!

FAQs About Meditation for Financial Health

1. Can meditation really improve my financial situation?

Yes! Meditation enhances clarity, focus, and emotional resilience, all of which are essential for making better financial decisions and handling challenges effectively.

2. How long does it take to see results from meditation?

You may notice reduced stress and improved focus after just a few sessions. For long-term financial benefits, consistency over weeks or months is key.

3. What kind of meditation is best for financial health?

Mindfulness and gratitude meditation are particularly effective. Guided meditations focused on abundance and financial success can also be beneficial.

4. Do I need any special tools or apps?

No special tools are required. However, apps like Calm, Insight Timer, and Headspace offer guided meditations tailored to stress relief and abundance.

5. Can meditation help with financial planning?

Absolutely! Meditation clears mental clutter, helping you focus on priorities and align your financial goals with your values.

Click here if you want know more information about Financial Wellness