I. Understanding Financial Wellness

A. What is Financial Wellness?

Financial wellness can be described as having developed a productive relationship with money that serves to meet your financial obligations and improve your standard of living while you achieve your financial goals. It’s not about how much land, billions, millions, or a few, but rather having a sense of security and satisfaction in your financial transactions. Basic elements are budgeting, saving, debt management and planning for the future. With financial wellness achieved, several improvements in life are often hailed: decreased stress levels, enriched happiness and enhanced interaction with others.

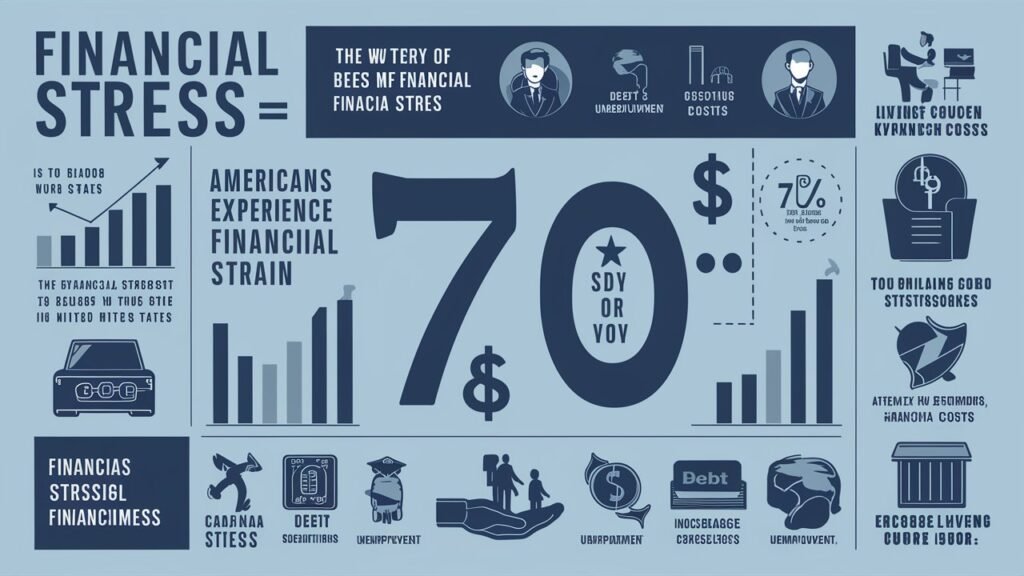

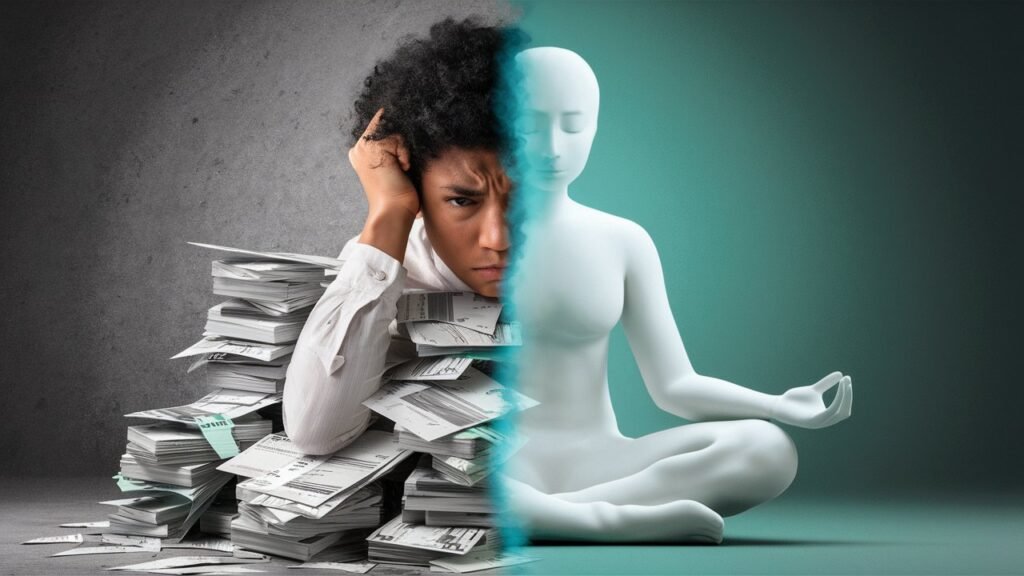

B. The Current State of Financial Wellness

Some of them struggle with financial stress. Studies have shown that around 70% of American individuals suffer from financial stress. Acute debt pressures mixed with insufficient savings and ignorance are causing the distress for high proportions of debt, low savings, and lack of financial education. With poor financial literacy raining as well as limited access to resources, individuals face barriers to financial wellness. Education and availability of resources are important keys to letting the individual grab and take control over their finances in order to attain financial peace and security.

C. Signs of Poor Financial Wellness

Indicators of financial distress can range from practical to emotional. If you value credit for everyday expenses and struggle in paying monthly bills, these can be considered signs of financial distress. Emotionally, stress, fear of being judged, or a feeling of powerlessness about finances can indicate deeper issues. On the practical side, you can start assessing your financial health by keeping tabs on your income, your expenditure, and leveling out debt. You could also use budgeting tools or apps to get an even clearer picture.

II. Introduction to Mindfulness

A. What is Mindfulness?

Mindfulness is considered to be a state of being aware and totally present in the moment without judgment. Mindfulness evolves from early forms of meditation practices, which, in contemporary society, have gained increasing popularity for its various claims in assisting attention and decreasing anxiety, depression, and achiness in so far as self-clarity and emotional balance is concerned. Many people wrongly believe that mindfulness is just about clearing the mind. Rather, it is the observance of the thoughts and feeling as they present themselves, providing an outlook of amazing clarity and emotional poise.

B. Mindfulness Practices: An Overview

There are many approaches to practicing mindfulness, including meditation, yoga, and simple breathing exercises, which can find a place in your busy day. One could use guided meditation and tips from Headspace apps or Calm apps to integrate mindfulness into your life quickly. Prioritization in your daily schedule will be important when you take some time to breathe and practice mindfulness.

C. The Science Behind Mindfulness

Research suggests positive effects of mindfulness on the brain by reducing areas associated with stress and anxiety. There are several studies that show how mindfulness practices help develop mental and emotional well-being and stress management. Also, mindfulness practice may facilitate the reduction of cortisol, which is generally elevated during periods of financial stress.

III. The Connection Between Financial Wellness and Mindfulness

A. How Mindfulness Affects Financial Decision-Making

Mindfulness practices foster emotional awareness, which is one of the most critical aspects of developing positive financial choices. This is done by engaging in reduced impulsive shopping through mindfulness, thus instilling patience and a long-term outlook into the finances. Imagine stopping to consider whether or not that late-night binge on online shopping really fits your goals before pressing buy.

B. Mindfulness as a Tool for Financial Management

Integrating mindfulness techniques into finances is transformational. Mindfulness can lead unnecessarily, for example, to realistic budgets that take on values and priorities. Spending with mindfulness allows one the time to ponder before making a purchase, while developing financial goals becomes more purpose-driven with an element of mindfulness.

C. Stress Reduction: A Common Ground

All financial stress makes its presence felt within the mind, thus a robust coping strategy becomes strikingly important. Mindfulness practice can help create a sense of relief from fiscal woes through enlightening self-revelations and affirmative statements about our financial situation. Reduce the anxiety about finances and calmly and clearly tackle money challenges.

IV. Practical Steps to Integrate Mindfulness into Financial Wellness

A. Setting Intentional Financial Goals

Begin the process of figuring out what is most important to you from a financial standpoint through mindful pondering. Compare it to financial security; what does it mean to you? Journal your thoughts or contemplate your financial goals, and in this process, you will open yourself to the possibilities that await. Finding harmony between your values and your finances is what really inspires a continued sense of purpose in handling your funds.

B. Creating a Mindful Budget

A budget shouldn’t feel like a straight jacket. Begin with your spending, finding those reasons that make you spend unplanned money. Consider using the envelope system or a digital budgeting tool to monitor spending and be sure that every expense line with your values. Check regularly, and tweak it depending on what is valuable to you.

C. Practicing Mindful Communication About Money

Open communication about personal finances can improve relationships among family members and partners. Active listening helps in conflict resolution and provides a safe space to discuss finances. Have regular check-ins with your loved ones to talk about financial goals and hurdles in a supportive manner.

V. Resources for Enhancing Financial Wellness and Mindfulness

A. Recommended Reading and Tools

Many books and guides offer powerful insights into financial wellness and mindfulness. Titles range from “The Total Money Makeover” by Dave Ramsey to “The Miracle of Mindfulness” by Thich Nhat Hanh. Additionally, you have online courses and workshops to amp up your skills, and budgeting apps, such as Mint or You Need A Budget (YNAB), will support you in keeping a close eye on the finances.

B. Finding Community Support

Connect with local seminars and community groups focused on financial wellness or mindfulness. Online discussions and social media give options for resources and support. Connecting with like-minded people inspires support and generates insight into problems.

C. Professional Guidance

If financial or emotional troubles are too great to face alone, seeking guidance from financial advisors or therapists is advisable. Many professionals are now offering services that combine financial and mental health support, ensuring that you address both aspects of your financial wellness.

Conclusion

The most important note about financial wellness is that it’s more than just numbers; it’s about being mindful about it to incorporate a well-rounded approach to your financial health. By being more mindful, you can create better money outcomes and well-being for your life. Take small steps today, and start seeing the positive changes that mindfulness can bring to your financial journey.

FAQs

- What is the first step to achieving financial wellness?

- The first step is to assess your current financial situation objectively, identifying areas that need improvement.

- Is mindfulness only beneficial for mental health?

- No, mindfulness benefits various aspects of life, including enhancing focus, relationships, and decision-making skills.

- Can practicing mindfulness really affect my spending habits?

- Yes! Mindfulness encourages reflection before making purchases, leading to more intentional spending habits.

- How do I know if I’m financially well?

- Assess your ability to meet your expenses, save for emergencies, and enjoy financial security without undue stress.

- Are there specific mindfulness practices that target financial stress?

- Yes, practices like budgeting reflections, meditation focused on abundance, and mindful spending exercises can specifically address financial stress.