Introduction

It’s all about being deliberate in your decisions about money. Knowing your money stories, feelings about money, spending triggers, and making decisions that align with your longer-term goals. This mindset gives you the freedom to focus on building wealth with peace of mind.

Do you feel stressed out about money? Many people find it hard to balance the trio of spending, saving, and planning for the future. But the key to overcoming financial pressure is not merely in earning more but in adopting an attitude of mindfulness towards managing money.

In this blog, we will take you through 10 powerful habits to help you develop a mindful mindset towards money. The habits are quite straightforward to develop and very effective in changing your perspective and approach toward your finances. No matter whether you are a beginner in your financial journey or aiming to find ways to invest, such habits are going to set you up for financial freedom.

1. Set Clear and Meaningful Financial Goals

Every large financial undertaking begins with a vision. If people lack goals, they may spend frivolously or save without any purpose. Goals serve as a road map, directing choices and sustaining motivation in times of trouble.

Why Goals Matter:

- They provide direction and purpose for your financial decisions.

- Clear goals help you prioritize spending and saving.

- They keep you motivated by giving you milestones to celebrate.

How to Do It:

- Short-Term Goals: Save for a vacation, pay off a small debt, or build an emergency fund.

- Mid-Term Goals: Plan for larger expenses like buying a car or saving for a down payment on a home.

- Long-Term Goals: Focus on retirement savings or achieving financial independence.

- Use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to create actionable goals.

Pro Tip: Break larger goals into smaller, achievable milestones. For example, if your goal is to save $10,000 in a year, set monthly goals of $834.

2. Track Every Dollar You Spend

Did you know most people usually underestimate their monthly expenses? Recording your spending behavior is a very simple yet transforming habit that can reflect where your money goes and give control to you over those expenses.

Benefits of Tracking:

- Increases awareness of spending habits.

- Identifies areas where you can cut back.

- Helps you align your spending with your goals.

How to Do It:

- Use apps like Mint, PocketGuard, or YNAB for automatic expense tracking.

- If you prefer manual tracking, create a spreadsheet with categories for essentials, discretionary spending, and savings.

- Review your expenses weekly and reflect on any unnecessary purchases.

Tracking every dollar isn’t about being restrictive—it’s about being intentional.

Download our free budgeting template to track your expenses effortlessly!

3. Practice Gratitude for What You Have

Gratitude is a powerful practice that changes the perception of your financial circumstances. Realizing what you have makes you less likely to desire superfluous physical things, thereby making you feel happier.

Why Gratitude Matters:

- Encourages a sense of abundance, not scarcity.

- Reduces impulsive spending driven by dissatisfaction.

- Helps you appreciate financial milestones, big or small.

How to Do It:

- Keep a gratitude journal and write down three financial blessings daily (e.g., steady income, savings progress, paying bills on time).

- Reflect on how far you’ve come in your financial journey.

- Celebrate small wins like saving on groceries or paying off a credit card balance.

Pro Tip: Pair your gratitude practice with a reflection on how your spending aligns with your values.

4. Create a Budget That Matches Your Values

Gratitude is a potent practice that will transform one’s perspective on financial circumstances. Recognizing what one has results in one’s being less inclined to wish for excessive material things, thereby resulting in happiness.

Why It Works:

- Ensures your spending reflects your priorities.

- Reduces stress by providing a clear plan for your money.

- Helps you save consistently without feeling deprived.

How to Do It:

- Start with the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt repayment.

- Adjust the percentages to suit your priorities. For example, if travel is a top value, allocate more to savings for trips.

- Use tools like Excel, Google Sheets, or budgeting apps to track progress.

When you budget according to your values, you’re more likely to stick with it.

5. Automate Your Savings

When saving gets difficult, it is extremely easy to automate the whole process. Transfers set up automatically would almost do the saving for you.

Benefits of Automation:

- Eliminates the temptation to spend what you should save.

- Ensures consistent contributions to savings and investments.

- Reduces the mental load of remembering to save manually.

How to Do It:

- Set up automatic transfers to a savings or retirement account on payday.

- Automate bill payments to avoid late fees.

- Review automated contributions annually to ensure they match your financial goals.

Pro Tip: Start with small automated amounts and gradually increase them as your income grows.

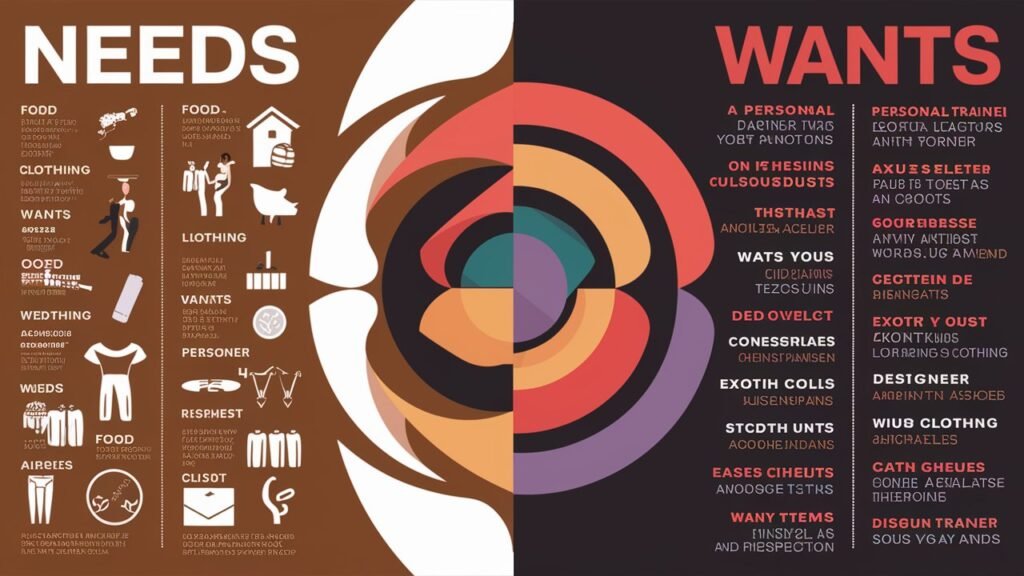

6. Differentiate Needs from Wants

Every expense is not equal, as needs and wants differ; hence, it becomes very easy for one to prioritize mandatory spending and cut unnecessary costs.

Why It Matters:

- It helps in minimizing impulse buying and subsequent diversion of one’s budget.

- To save more in the essentials to buy what you may need right now.

- It promotes a more thoughtful approach to spending money.

How to Do It:

- Ask yourself before every purchase: Is this a need or a want?

- Use the 24-hour rule for discretionary spending. Wait a day before buying non-essentials to avoid impulse purchases.

- Create a monthly list of needs versus wants to guide your spending.

This habit ensures your money is spent on what truly matters.

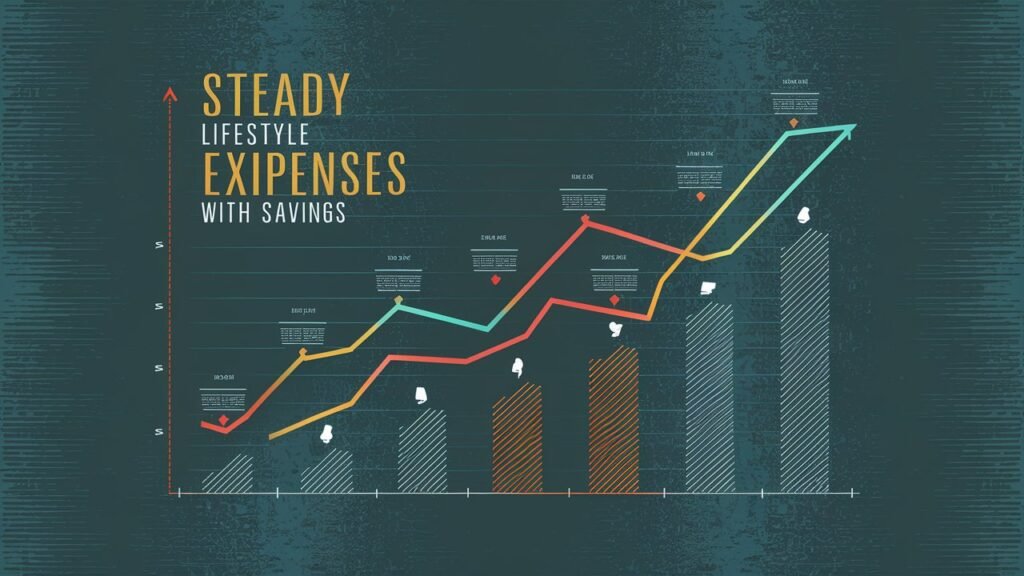

7. Avoid Lifestyle Inflation

Lifestyle inflation happens when people tend to way their expenditures to income, thus with increase in income people increase their style of living as well. Hence, though lifestyle upgrades are enticing, this one habit would discourage you from building wealth.

Why Avoiding It Matters:

- Will help you hold your savings rate steady or even grow.

- It minimizes any credit card debts to keep up with the Joneses.

- It makes you focus on future goals rather than on immediate gratification.

How to Do It:

- When you get a raise, allocate a portion to savings or investments before increasing your spending.

- Focus on contentment rather than comparison.

- Regularly revisit your goals to remind yourself why you’re saving.

Pro Tip: Treat financial windfalls (like bonuses or tax refunds) as opportunities to boost your savings or pay off debt.

8. Learn About Money Regularly

Financial literacy is no one-time achievement. It is an ongoing endeavor-the more one learns towards this end, the better the skills ready to make informed decisions concerning wealth-building.

Why It’s Important:

- Gives you differential advantage in making smarter choices about money.

- Information on trends, tools, and strategies.

- Produces confidence in the management and growth of money.

How to Do It:

- Read personal finance books like The Millionaire Next Door.

- Listen to podcasts such as The Dave Ramsey Show or Afford Anything.

- Take online courses on budgeting, investing, or retirement planning.

Pro Tip: Dedicate just 10 minutes a day to learning about money. Over time, these small efforts will add up.

9. Surround Yourself with Supportive People

Your social circle affects your financial behavior. Just being around like-minded, financially conscientious people can keep you motivated and accountable.

How to Do It:

- Get involved in online communities centered on financial independence or personal finance.

- Exchange updates or discuss financial goals with trusted friends or family.

- Find a mentor who can provide wisdom and support.

Being around positive influences helps you stay on track and inspired.

10. Reflect on Your Financial Progress

Mindfulness is the state of regular reflection. Accounting for the steps taken on the financial pathway gives one an opportunity for celebrating success, learning from losses, and correcting strategies.

Why It’s Important:

- It inspires self-awareness and confirms accountability.

- Recognizing accomplishments sustains motivation.

- Refines each goal post on the bigger trail of habit-building.

How to Do It:

- Schedule a monthly “money check-in” to review your spending, savings, and goals.

- Write down lessons learned and adjustments needed in a journal.

- Celebrate milestones, no matter how small, to stay encouraged.

Pro Tip: Use a reflective journal to track how your mindset and finances evolve over time.

Conclusion

Building a mindful money mindset is a journey, not merely a destination. Through these 10 tips, you will create a solid base for steady growth of wealth, as well as cultivate peace of mind for generations. Start small and stay consistent, and remember, every positive step you take brings you a step closer to financial freedom.

FAQs

Q: What is a mindful money mindset?

A: It’s the practice of being intentional and purposeful with your financial decisions, aligning them with your goals and values.

Q: How can these habits help me build wealth?

A: They focus on mindful spending, saving, and long-term planning, which are essential for sustainable financial growth.

Q: Do I need tools to get started?

A: Tools like budgeting apps can help, but the most important resource is your commitment to building better habits.

Q: How quickly will I see results?

A: While some habits may show immediate benefits (like tracking spending), long-term habits like saving and investing take time to compound.