Introduction: Why Conscious Investing Matters

Investing today is no longer just about growing your wealth. It’s about making your money work for you and for the world around you. Conscious investing allows you to align your financial decisions with your values and support the causes you care about while ensuring bright prospects for financial continuation.

Whether it’s fighting climate change, promoting diversity, or encouraging businesses to abide by ethical practices, conscious investing is a powerful way to drive meaningful change. And what’s more, you don’t have to forfeit financial returns to have an impact.

A novice may feel that the world of conscious investing is intimidating. However, with a little guidance and the right tools, it is possible to start small and build a portfolio that positions profit alongside purpose. Here are 10 actionable tips, to help you on your way to being a confident conscious investor.

1. Understand the Basics of Conscious Investing

Conscious investing is choosing investments that align with your beliefs. This process uses the ESG (Environmental, Social, and Governance) principles to evaluate investment opportunities.

Breaking Down ESG:

- Environmental: This looks at a company’s impact on the planet. Examples: Renewable energy initiatives, waste management, and carbon neutrality:

- Social: This looks at the wellbeing of employees, customers, and communities. Example: Labor rights and diversity.

- Governance: This looks at integrity and responsibility within a corporate setting. Example: Transparency, responsible decisions, and effective management.

Pro Tip: Make a note of what values matter to you..

2. Align Your Values with Your Portfolio

Instead of dwelling on practice and practical arguments, it would be wise to take some time to ponder your values. Ask yourself:

- Which causes mean the most to me?

- Am I okay with renewable energy, gender equality, or fair trade?

- Are slightly lower returns acceptable for higher social impact?

Actionable Steps to Align Values:

- Research industries and firms that benefit your causes.

- Avoid those industries and companies that run counter to your principles and values, like fossil fuels or tobacco.

- Use MSCI ESG Ratings, Sustainalytics, or certain tools to search for companies aligned with your aspirations.

Pro Tip: Create a values checklist” to assess potential investments and ensure they match your priorities.

3. Research ESG Ratings to Evaluate Companies

Not all companies claiming to be sustainable are genuine. ESG ratings offer a clear avenue for evaluating whether a business follows its avowed principles.

How to Use ESG Ratings:

- MSCI ESG Ratings: In-depth analysis of companies based on their ESG performance.

- Sustainalytics: Focuses on risk and provides investable recommendations for investors.

- Morningstar Sustainability Ratings: Shows how the ESG impact of different funds ranks.

Red Flags to Watch For:

- Vague or inconsistent sustainability claims.

- Pressure on one or two aspects of ESG, neglecting other aspects.

- Magical dust or voodoo data points; lack of measurable impact in reporting.

4. Start with Sustainable Mutual Funds and ETFs

Instead of analyzing the companies on an individual basis, there may be an easier way to start with an investment in sustainable mutual funds or ETFs. These contain companies complying with ESG standards and may provide an easier entrance into the world of investment for a more novice investor.

Popular Options for Beginners:

- Vanguard FTSE Social Index Fund: invests in socially responsible companies.

- iShares Global Clean Energy ETF: focused on renewable energy stocks.

- Calvert Equity Fund: keeps companies with pledges toward environmental and social impact.

Pro Tip: Ensure you look at the prospectus for any fund, making sure it meets your values and has earned brilliant returns over the years.

5. Avoid Falling for Greenwashing

Greenwashing refers to corporate practices to exaggerate or falsify sustainable efforts to attract ethical investors. You must identify such practices for conscious investing.

Signs of Greenwashing:

- Overburdening the usage of vague terms describing particular environmental issues without specific evidence.

- Certifications or third parties have not validated the marketing claims.

- The distinction between reputation and actual business practices, such as claiming to be environmentally friendly while burning fossil fuels.

How to Avoid Greenwashing:

- Review company sustainability reports, which may provide more clarity on the issue.

- Credentials or certifications, like B Corp or Fair Trade, are definitive.

- Use websites like GreenBiz to uncover greenwashing controversies.

6. Balance Profit and Purpose

Investing with a conscious mind does not equate to sacrificing returns. From one such demonstration, companies focused on ESG metrics did show performance that could lead one to the conclusion that finance and fund supporting good causes could coexist.

Examples of High-Performing ESG Investments:

- Tesla: Renewable energy innovator.

- NextEra Energy: Committed to clean energy.

- Unilever: Commended for its sustainable supply chain practices.

Pro Tip: Be careful not to overrate ethical issues at the cost of financial stability. Strive toward a balance between impact and returns.

7. Diversify Your Portfolio

Diversification enhances the reduction of risk and increases the chance for long-term success. Witness this happening in conscious investing, where your investment is distributed across different industries, regions, and asset types.

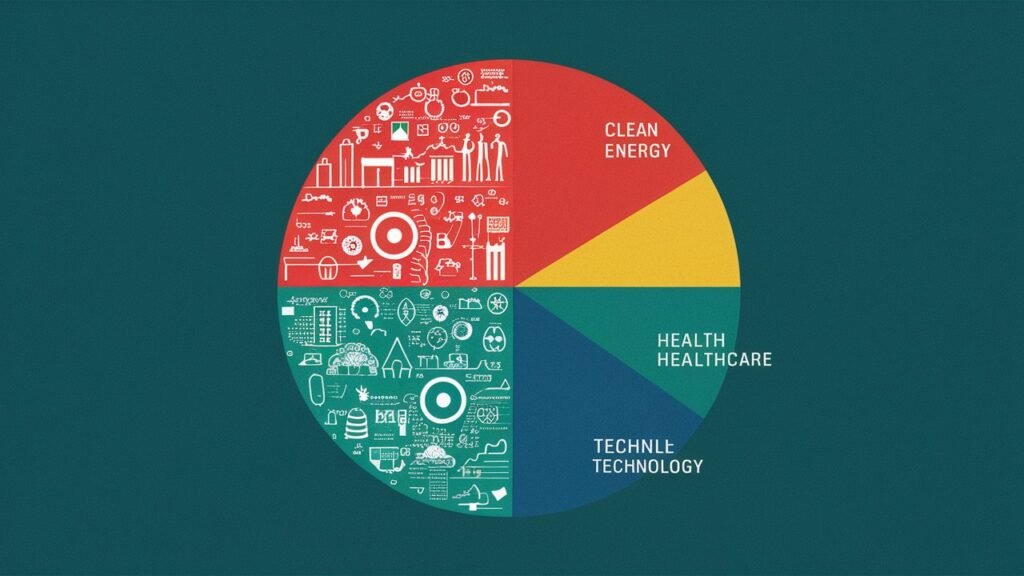

How to Diversify Consciously:

- Include a mix of Renewable Energy, Ethical Technology, and Sustainable Agriculture stocks.

- Further explore the international market for ESG-focused companies.

- Green bonds and social impact funds could make an addition for stability.

8. Explore Impact Investing

While ESG focused more on compliance, impact investing does a lot more by calling for measurable positive outcomes. The strategy directly supports businesses and projects aimed at mitigating global problems.

Examples of Impact Investments:

- Funding solar farms or wind energy projects.

- Supporting startups developing clean water solutions.

- Investing in microfinance platforms that empower low-income communities.

Pro Tip: Start at low limits on things such as Kiva or CNote, if you like.

9. Use Technology to Simplify Your Journey

Different platforms and various applications are taking conscious investing on board and making it more convenient for amateurs through simplified research, tracking, and investing processes.

Best Apps for Beginners:

- Betterment: offers curated vp socially responsible portfolios.

- Acorns ESG: automates investment into ESG-friendly funds.

- EarthFolio: specializes in impact-driven portfolios

10. Commit to a Long-Term Mindset

Conscious investment is the beginning of a long and rich journey; long-term investments must be full of impatience in order to be successful financially and to make an ever-lasting impact on social justice and environmental stability.

Tips for Long-Term Success:

- Each year, take time to assess your investments in line with your values.

- Learn about the changes in ESG standards as well as new opportunities.

- Appreciate small milestones like funding a renewable energy project or a sustainable innovation.

FAQs About Conscious Investing

1. Can I Start Conscious Investing with $100?

Yes! Many platforms and ETFs allow you to start with small amounts. Apps like Acorns or Betterment are great options for beginners.

2. Are Conscious Investments Riskier Than Traditional Investments?

Not necessarily. Diversification and careful selection can mitigate risks, making ESG investments as safe as traditional options.

3. How Do I Know If a Fund Is Truly ESG-Compliant?

Research its holdings, read its prospectus, and check for third-party certifications like MSCI ESG Ratings.

4. Can I Include Conscious Investing in My Retirement Plan?

Absolutely! Many retirement funds now offer ESG-friendly options. Check with your financial advisor or plan provider.

5. What’s the Difference Between ESG and Impact Investing?

ESG investing focuses on companies that meet environmental, social, and governance criteria, while impact investing aims to create measurable social or environmental benefits.

Conclusion: Take the First Step Toward Conscious Investing

Conscious investing is neither a fad nor a casual undertaking taken up for fun; by conscious investing, one can create an enormous wealth while contributing toward creating a better world. Here are 10 tips to begin your journey toward responsible and impactful investing with confidence.

A small decision could go a long way. Whether you invest in an ESG fund, put money into renewable energy projects, or avoid greenwashing companies, your investment decision can generate a huge ripple effect for positive change.

Ready to align your values with your investments? Start today with a sustainable mutual fund, research ESG ratings, or explore impact investing opportunities. Your portfolio and the planet will thank you!