Table of Contents

- Understanding Credit Basics

- Step 1: Get Started with a Credit Builder Account

- Step 2: Become an Authorized User

- Step 3: Get Your First Credit Card

- Step 4: Master Credit Utilization

- Step 5: Set Up Automatic Payments

- Step 6: Monitor Your Credit Regularly

- Step 7: Be Patient and Consistent

- Common Credit Building Mistakes

- Frequently Asked Questions

Introduction

Starting your credit journey can feel overwhelming I remember staring at my credit report showing insufficient credit history and having no idea where to begin. You’re not alone if you’ve been denied for credit cards or told you need credit to get credit. It’s frustrating, but here’s the truth: building credit from scratch is absolutely possible with the right strategy.

Over 45 million Americans have no credit score at all, and millions more are trying to rebuild after financial setbacks. The good news? Credit building for beginners doesn’t have to be complicated or expensive when you know the proven steps that actually work.

In this complete guide, you’ll discover:

- The exact 7-step process I used to build credit from zero to 750+

- The best credit building tools and apps for 2025

- Common mistakes that can set you back months (and how to avoid them)

- Realistic timelines for seeing results

- Free resources to monitor your progress

Whether you’re 18 with no credit history, new to the US, or rebuilding after financial difficulties, this step-by-step credit building guide will give you everything you need to succeed.

Ready to begin your credit building journey? Get started with Kovo today and take the first step toward excellent credit

Understanding Credit Basics

Before diving into credit building strategies, let’s cover the fundamentals every beginner needs to know.

What Is a Credit Score?

Your credit score is a three digit number typically between 300-850 that represents your creditworthiness to lenders. Think of it as your financial report card it tells banks, landlords, and even employers how likely you are to pay back money you borrow.

The five factors that determine your credit score:

- Payment History (35%) – Whether you pay bills on time

- Credit Utilization (30%) – How much credit you use vs. your limits

- Credit History Length (15%) – How long you’ve had credit accounts

- Credit Mix (10%) – Variety of credit types (cards, loans, etc.)

- New Credit (10%) – Recent credit applications and new accounts

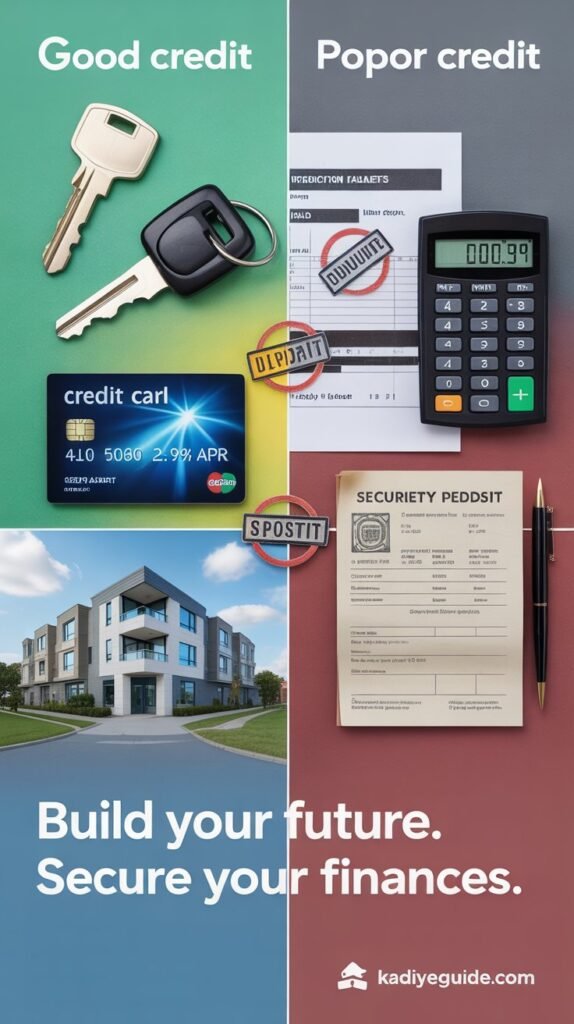

Why Building Credit Matters

Good credit opens doors to:

- Lower interest rates on loans and credit cards

- Better apartment rentals without huge security deposits

- Lower insurance premiums in many states

- Better job opportunities (some employers check credit)

- Higher credit limits and better rewards cards

Step 1: Get Started with a Credit Builder Account

For beginners with no credit history, a credit builder account is often the fastest and safest way to start building credit. Unlike traditional credit cards that require existing credit, these accounts are designed specifically for people starting from zero.

What Is a Credit Builder Account?

A credit builder account works differently than a regular credit card:

- You make small monthly payments (usually $10-25)

- The company reports these payments to credit bureaus

- After 12-24 months, you’ve built a positive payment history

- No credit check required for approval

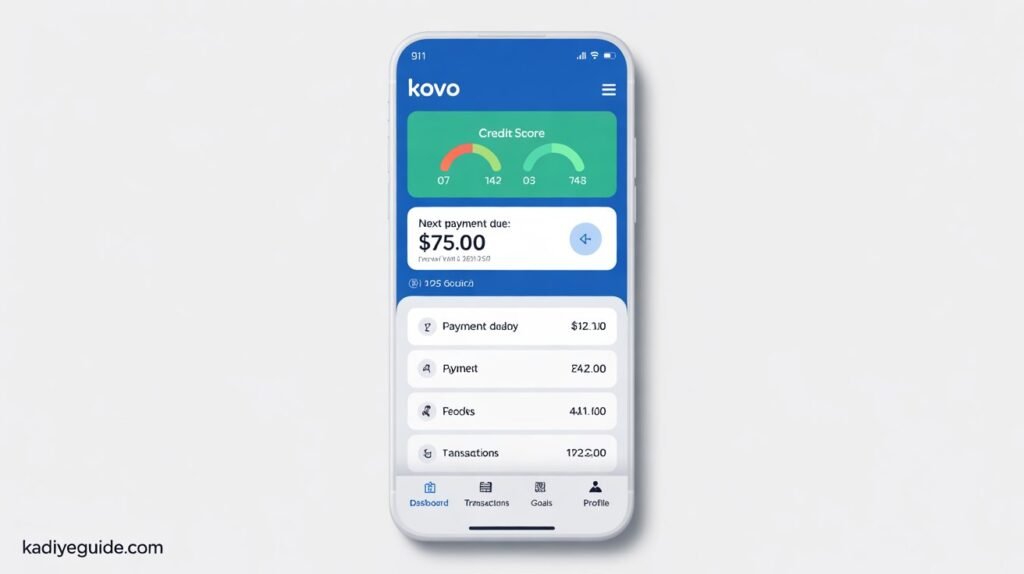

Why Kovo Is Perfect for Beginners

After researching dozens of credit builder options, Kovo stands out as the best choice for beginners in 2025. Here’s why:

Kovo’s Beginner-Friendly Features:

- ✅ Instant approval with no credit check required

- ✅ Reports to all 4 credit bureaus (Experian, Equifax, TransUnion, and Innovis)

- ✅ Only $10 per month with no hidden fees

- ✅ 24-month program with guaranteed credit building

- ✅ 4.9-star rating from over 10,000 users

- ✅ 0% APR – no interest charges ever

How Kovo Works:

- Sign up online in 2 minutes (no credit check)

- Choose your monthly payment amount ($10-25)

- Kovo reports your payments to all credit bureaus

- Watch your credit score grow over 24 months

- Build credit while saving money

Real Results: Users typically see their first credit score appear within 2-3 months, with average increases of 40-60 points in the first year.

Alternative Credit Builder Options

While Kovo is my top recommendation, here are other solid options for credit building beginners:

| Credit Builder | Monthly Cost | Credit Bureaus | Approval | Best For |

| Kovo | $10 | All 4 | Instant | Complete beginners |

| Self | $25 | 3 bureaus | Instant | Higher budget |

| Kikoff | $5 | 2 bureaus | Instant | Lowest cost |

| Credit Strong | $15 | 3 bureaus | Instant | Mid-range option |

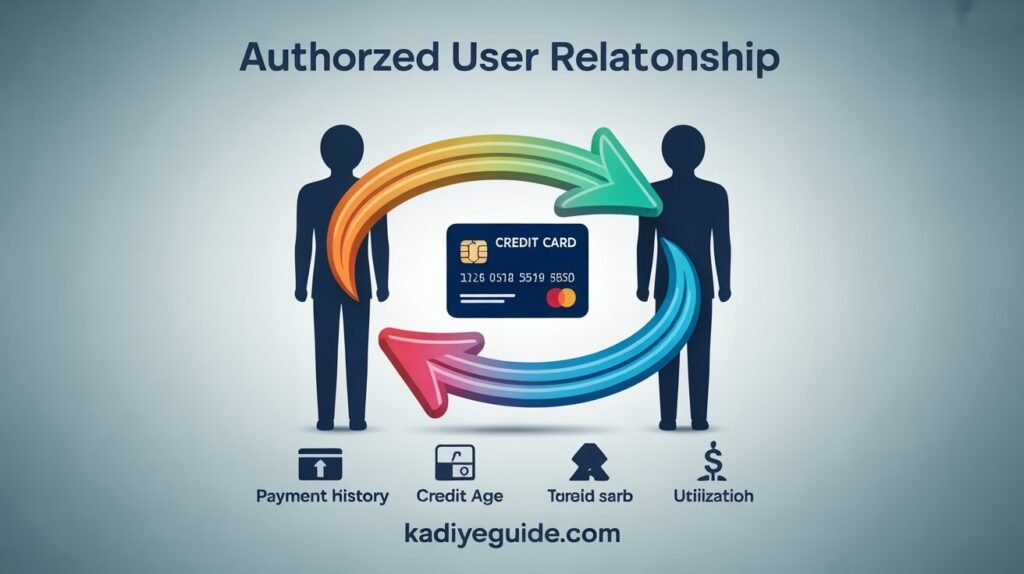

Step 2: Become an Authorized User

While your credit builder account establishes your foundation, becoming an authorized user can accelerate your credit building timeline significantly.

How Authorized User Status Works

When someone adds you as an authorized user to their credit card:

- Their entire account history appears on your credit report

- You benefit from their positive payment history and low utilization

- You get a credit card to use (optional)

- Their account age boosts your average account age

Finding the Right Primary Cardholder

Ideal authorized user accounts have:

- Payment history of 100% on-time payments

- Low credit utilization (under 10%)

- Account age of 2+ years

- No recent late payments or negative marks

Who to ask:

- Parents or family members with excellent credit

- Trusted friends with responsible credit habits

- Spouse or partner with established credit

Setting Clear Expectations

Before becoming an authorized user:

- Discuss whether you’ll actually use the card

- Agree on spending limits and responsibilities

- Understand you can be removed at any time

- Clarify who pays for any charges you make

Step 3: Get Your First Credit Card

Once you have 3-6 months of credit history from your credit builder account, you’ll be ready to apply for your first credit card. This is a crucial step in credit building for beginners.

Best First Credit Cards for Beginners

Secured Credit Cards (Easiest Approval):

- Capital One Platinum Secured: $0 annual fee, $49-200 deposit

- Discover it Secured: Cashback rewards, $200 minimum deposit

- Citi Secured Mastercard: Low deposit options, reports to all bureaus

Student Credit Cards (If You’re in College):

- Discover it Student: 5% rotating categories, no annual fee

- Capital One SavorOne Student: Unlimited 3% on dining and entertainment

- Chase Freedom Student: Bonus categories and no foreign transaction fees

- Capital One Platinum: For fair credit, no annual fee

- Credit One Bank Platinum: Pre-qualification available

- OpenSky Secured: No credit check required

Credit Card Application Strategy

Before applying:

- Check your credit score (should be 580+ for best approval odds)

- Gather required information (income, employment, housing costs)

- Apply for only one card at a time

- Consider pre-qualification tools to check approval odds

Application tips:

- Be honest about your income (include part-time work, financial aid)

- Don’t apply for multiple cards in a short period

- Start with your bank or credit union

- Consider secured cards if denied for unsecured cards

Step 4: Master Credit Utilization

Credit utilization how much of your available credit you use makes up 30% of your credit score. For credit building beginners, understanding and optimizing utilization is crucial for fast results.

The Credit Utilization Formula

Credit Utilization = (Total Balances) ÷ (Total Credit Limits) × 100

Example: If you have a $500 credit limit and a $50 balance: $50 ÷ $500 × 100 = 10% utilization

Optimal Utilization Targets

For maximum credit score impact:

- Overall utilization: Keep below 10%

- Individual cards: Keep each card below 30%

- Perfect scenario: 1-9% utilization (not 0%)

Why not 0%? Using some credit shows lenders you actively use accounts responsibly. Aim for 1-9% for the highest credit scores.

Smart Utilization Strategies

Strategy 1: Multiple Payment Method

- Make payments multiple times per month

- Pay before your statement closes

- Keep reported balances low

Strategy 2: Request Credit Limit Increases

- After 6 months of on-time payments

- Ask for increases without hard credit pulls

- Higher limits lower utilization percentage

Strategy 3: Spread Balances Across Cards

- Don’t max out individual cards

- Keep each card under 30% utilization

- Monitor both individual and overall ratios

Step 5: Set Up Automatic Payments

Payment history accounts for 35% of your credit score the largest factor. For credit building beginners, automating payments eliminates the risk of missed payments that can devastate your score.

Payment Automation Options

Full Balance Autopay (Recommended):

- Pays entire statement balance automatically

- Avoids interest charges completely

- Ensures 100% on-time payment history

Minimum Payment Autopay:

- Pays only minimum required amount

- Prevents late fees and score damage

- Still results in interest charges on remaining balance

Fixed Amount Autopay:

- Pays set dollar amount each month

- Good for budgeting and controlling spending

- Ensure amount covers minimum payment

Setting Up Autopay Successfully

Best practices:

- Link to checking account with sufficient funds

- Set payment date 2-3 days before due date

- Monitor statements even with autopay enabled

- Keep backup payment method in case autopay fails

- Review and adjust payment amounts quarterly

Common autopay mistakes to avoid:

- Setting payment date too close to due date

- Not monitoring account for sufficient funds

- Forgetting to update bank account information

- Assuming autopay means you don’t need to review statements

Step 6: Monitor Your Credit Regularly

Regular credit monitoring helps you track progress, catch errors, and identify potential fraud. For beginners building credit, monitoring is essential to ensure your efforts are paying off.

Free Credit Monitoring Options

Credit Karma (Recommended for Beginners):

- Completely free credit scores and reports

- Updates weekly from TransUnion and Equifax

- Credit improvement recommendations

- Identity monitoring and alerts

- Simple, easy-to-understand interface

Other free monitoring services:

- Experian (free): FICO score updates

- Credit.com: Credit report analysis

- Annual Credit Report: Official free annual reports

- Bank/credit card apps: Many provide free scores

What to Monitor Monthly

Credit score changes:

- Track improvements over time

- Identify factors affecting your score

- Celebrate milestones and progress

Credit report accuracy:

- Verify all accounts belong to you

- Check payment history for errors

- Ensure account statuses are correct

- Look for unauthorized inquiries

Account activity:

- Monitor for fraudulent charges

- Review credit limit changes

- Track new account openings

- Watch for identity theft signs

Disputing Credit Report Errors

If you find errors on your credit report:

- Gather documentation supporting your dispute

- File disputes online with each credit bureau

- Include clear explanation of the error

- Follow up within 30 days for resolution

- Keep records of all communications

Step 7: Be Patient and Consistent

Credit building for beginners requires patience and consistency. Understanding realistic timelines helps set proper expectations and maintain motivation throughout your credit journey.

Realistic Credit Building Timeline

Month 1-3: Foundation Building

- Credit builder account reports first payments

- Authorized user accounts appear on report

- First credit score may appear (if starting from scratch)

- Expected score range: 580-620

Month 3-6: Early Progress

- Credit card approval becomes more likely

- Score improvements from payment history

- Credit mix begins to develop

- Expected score range: 620-680

Month 6-12: Significant Growth

- Multiple accounts reporting positive history

- Credit utilization optimization shows impact

- Average account age begins improving

- Expected score range: 680-720

Month 12-24: Mature Credit Profile

- Well-established payment history

- Access to better credit cards and rates

- Credit score stability and continued growth

- Expected score range: 720-780+

Maintaining Motivation

Track your progress:

- Screenshot credit scores monthly

- Celebrate score increases

- Document approved applications

- Share success with supportive friends/family

Focus on the benefits:

- Calculate money saved on lower interest rates

- Research better credit cards you’ll qualify for

- Plan for major purchases (car, home) with good credit

- Appreciate the financial security good credit provides

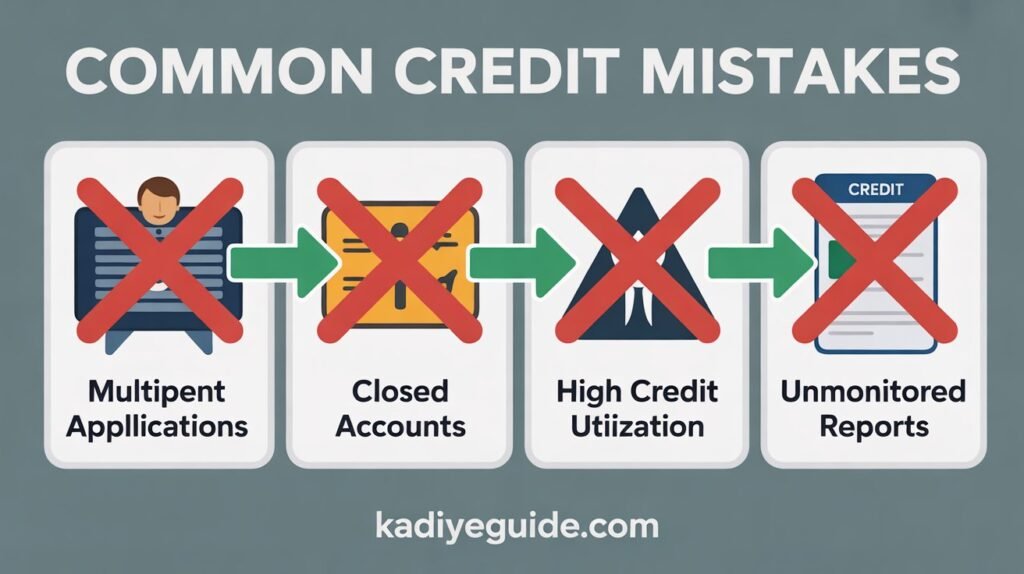

Common Credit Building Mistakes to Avoid

Learning from common mistakes can save you months of setbacks in your credit building journey. Here are the most frequent errors beginners make:

Mistake 1: Applying for Too Many Cards at Once

The problem: Multiple credit applications in a short period hurt your credit score and suggest desperation to lenders.

The solution:

- Apply for one credit card every 3-6 months

- Use pre-qualification tools to check approval odds

- Focus on building history with existing accounts

Mistake 2: Closing Old Credit Cards

The problem: Closing cards reduces your available credit and shortens your credit history.

The solution:

- Keep old cards open, even if you don’t use them

- Make small purchases occasionally to keep accounts active

- Only close cards with annual fees if benefits don’t justify the cost

Mistake 3: Ignoring Credit Utilization

The problem: High balances relative to credit limits can dramatically lower your score.

The solution:

- Keep total utilization below 10%

- Pay balances before statement closing dates

- Request credit limit increases to lower utilization ratios

Mistake 4: Making Only Minimum Payments

The problem: While minimum payments protect your credit score, interest charges accumulate rapidly.

The solution:

- Pay statement balances in full when possible

- If carrying balances, pay more than the minimum

- Use balance transfer cards for existing high-interest debt

Mistake 5: Not Monitoring Your Credit

The problem: Errors, fraud, or identity theft can damage your credit without your knowledge.

The solution:

- Check credit scores monthly

- Review credit reports quarterly

- Set up fraud alerts and credit monitoring

- Dispute errors immediately when found

Advanced Credit Building Strategies

Once you’ve mastered the basics, these advanced strategies can accelerate your credit building progress:

Strategy 1: Credit Card Churning (Advanced Users Only)

What it is: Opening new credit cards for signup bonuses while managing utilization and payment history.

Requirements:

- Excellent payment history (12+ months)

- Low utilization across all accounts

- Stable income and spending discipline

Strategy 2: Balance Transfer Optimization

How it works: Use 0% APR balance transfer offers to consolidate high-interest debt while building credit.

Best practices:

- Transfer balances to cards with 0% intro APR

- Pay off transferred balances before promotional rate expires

- Don’t close the paid-off cards

Strategy 3: Credit Piggybacking Services

What it is: Paid services that add you as an authorized user to strangers’ accounts with excellent credit history.

Considerations:

- Can be expensive ($200-800 per account)

- Results are temporary unless you build your own credit

- Some lenders may not count these accounts

Frequently Asked Questions

How long does it take to build credit from scratch?

Most beginners see their first credit score within 3-6 months of opening their first credit account. Reaching a good credit score (670+) typically takes 6-12 months with consistent, responsible credit use.

Can I build credit without a credit card?

Yes! Credit builder accounts, authorized user status, and alternative credit reporting (rent, utilities) can help build credit without traditional credit cards. However, credit cards often provide the fastest path to building credit.

What credit score do I need to rent an apartment?

Most landlords prefer tenants with credit scores of 620 or higher. However, requirements vary by location and landlord. Some accept scores as low as 580 with additional security deposits.

Should I pay off my credit cards in full every month?

Yes, paying statement balances in full helps you avoid interest charges while building positive payment history. This is the most cost-effective way to build credit.

How many credit cards should a beginner have?

Start with one credit card and focus on building positive payment history. After 6-12 months of responsible use, you can consider adding a second card to improve your credit mix and lower overall utilization.

Will checking my credit score hurt my credit?

No, checking your own credit score is a soft inquiry that doesn’t affect your credit score. You can check as often as you want through free monitoring services.

What’s the difference between credit score and credit report?

Your credit report contains detailed information about your credit accounts, payment history, and personal information. Your credit score is a three-digit number calculated from the information in your credit report.

Can I build credit if I’m not a US citizen?

Yes, but it may be more challenging. Consider starting with a secured credit card, becoming an authorized user, or working with banks that serve international customers. Some credit builder accounts also accept non-citizens.

Conclusion

Building credit from scratch doesn’t have to be overwhelming when you follow the right steps. By starting with a credit builder account like Kovo, becoming an authorized user, and gradually adding traditional credit products, you can establish excellent credit within 12-24 months.

Remember the key principles of credit building for beginners:

- Start with credit builder accounts for guaranteed approval and progress

- Always pay on time payment history is 35% of your score

- Keep utilization low below 10% for optimal scores

- Monitor your progress regularly to catch errors and track improvement

- Be patient and consistent good credit takes time to build

The journey to excellent credit starts with your first step. Whether you choose Kovo’s credit builder program, become an authorized user, or apply for your first credit card, the most important thing is to begin today.

Your future self will thank you for taking control of your credit and opening doors to better financial opportunities. Start building the credit score you deserve you’ve got this!

Ready to begin your credit building journey? Get started with Kovo today and take the first step toward excellent credit

This article contains affiliate links. We may earn a commission if you sign up for products mentioned, at no additional cost to you. All recommendations are based on genuine research and personal experience.

📬 Want more productivity tips like this?

Subscribe to our newsletter for weekly guides on digital tools that make your life easier.